Get the free declaration liabilities kenya

Show details

THE REPUBLIC OF UGANDA LEADERSHIP CODE ACT 2002 DECLARATION OF INCOME ASSETS AND LIABILITIES FORM NOTE LEADERS ARE ADVISED TO CAREFULLY READ THE NOTES FOR COMPLETION OF DECLARATION OF INCOME ASSETS AND LIABILITIES ON THE NEXT PAGE BEFORE COMPLETING THIS FORM. For each form submitted there will be an acknowledgement slip issued. In completing paragraph 10 detailed information should be given to explain how the landed property vehicles machinery boats shares etc were acquired. You are expected...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign assets liabilities deadline form

Edit your uganda declaration income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wealth deadline servants form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing declaration online reliabilities online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit declaration assets reliabilities form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uganda declaration assets form

How to fill out Uganda Declaration of Income Assets and Liabilities Form

01

Begin by obtaining the Uganda Declaration of Income Assets and Liabilities Form from the relevant authority or website.

02

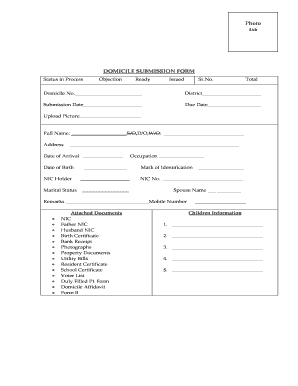

Fill in your personal details, including your full name, ID number, and contact information.

03

Describe your sources of income, including your salary, business income, and any other sources.

04

List all your assets, such as real estate, vehicles, bank accounts, and investments with their respective values.

05

Declare any liabilities, including loans, mortgages, or other financial obligations.

06

Ensure all information is accurate and up to date to avoid discrepancies.

07

Sign and date the form to verify that the information provided is true and complete.

08

Submit the completed form to the designated authority by the deadline.

Who needs Uganda Declaration of Income Assets and Liabilities Form?

01

Individuals holding certain public offices in Uganda.

02

Public servants and civil servants as part of their accountability.

03

Business owners and entrepreneurs who are required to declare their financial standing.

04

Anyone applying for certain licenses or permits that require financial disclosure.

Video instructions and help with filling out and completing declaration liabilities kenya

Instructions and Help about declaration assets form sample

Fill

declaration income reliabilities form

: Try Risk Free

People Also Ask about declaration assets extension

How do I make a declaration form?

Here's how it works Edit your i hereby declare online. Type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Share your form with others.

What is a declaration form?

A declaration form is a document that outlines all the information that is relevant and obtainable in a particular situation. In a declaration form, the person filling the form is expected to provide truthful and accurate information as is required.

How do you fill out assets and liabilities form?

Enter total cost of all the buildings (in the form of Flats, Bungalows, shops etc.) owned by you. Enter total amount of Fixed Deposits, Recurring Deposits and Saving/Current Account Balances with all Banks. Enter the total Cost of Shares, debentures, bonds, mutual funds units etc.

How to fill asset declaration form?

Provide details of asset (registration of assets or account number) wherever applicable. For example, for land, vehicles, yachts, boats etc. provide registration details of the asset. For shares, bonds, debentures etc., provide account number and name of the entity/institution the asset is held with.

How to fill asset declaration form in Nigeria?

When filling the form, you are required to provide detailed information including but not limited to the number, types, address, value of properties so declared and the date of acquisition as well as income derivable from the properties where appropriate.

How do I declare assets to IGG?

Editing igg declaration online Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing. Edit declaration of assets and liabilities form online.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit uganda declaration fillable from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including declaration income liabilities form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send income assets form download for eSignature?

To distribute your declaration income assets liabilities, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my uganda declaration assets in Gmail?

Create your eSignature using pdfFiller and then eSign your declaration income assets pdf immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is Uganda Declaration of Income Assets and Liabilities Form?

The Uganda Declaration of Income Assets and Liabilities Form is a financial disclosure document that individuals and entities are required to complete, reporting their income, assets, and liabilities to promote transparency and accountability.

Who is required to file Uganda Declaration of Income Assets and Liabilities Form?

Public officials, government employees, and anyone in a position of authority or responsibility that could lead to conflicts of interest are required to file the Uganda Declaration of Income Assets and Liabilities Form.

How to fill out Uganda Declaration of Income Assets and Liabilities Form?

To fill out the Uganda Declaration of Income Assets and Liabilities Form, one must accurately disclose their income sources, list all assets and their values, and specify any liabilities. Proper documentation and evidence may be required to support the claims made in the form.

What is the purpose of Uganda Declaration of Income Assets and Liabilities Form?

The purpose of the Uganda Declaration of Income Assets and Liabilities Form is to ensure transparency in financial dealings of public officials, prevent corruption, and enable the government to monitor the wealth of individuals in positions of power.

What information must be reported on Uganda Declaration of Income Assets and Liabilities Form?

The form must report details such as sources of income, types and values of assets (such as properties, investments, and vehicles), outstanding debts or liabilities, and any other financial information pertinent to an individual's financial status.

Fill out your Uganda Declaration of Income Assets and Liabilities Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uganda Declaration Form Online is not the form you're looking for?Search for another form here.

Keywords relevant to igg assets declaration

Related to online asset declaration form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.